What is the future of insurance and what kind of changes do we expect to see in the coming years? No one can forecast this, but it includes the best usage of technology.

Insurance Hackathon announced! A team of freshmen and a freshwoman connect their power at the Insurance Hackathon of Crowdpolicy, presenting a great idea, in front of AXA, NN, Eurolife, Anytime (by Interamerican), EY, IBM and other companies around the insurance field.

This idea will change the insurance game, firstly in life and health insurance, solving major problems and creating new opportunities globally.

It’s an honor for us, watching insurance companies like Eurolife, trying to adopt solutions like our ideas, improving the customer experience for the insurer and the agent.

Problems identified in the insurance industry

Most insurance companies are still using heavy procedures in the underwriting of a new health insurance application form.

It is heavy not only because of the way they communicate inside the headquarters but also communicating with their partners (sales offices, hospitals, etc.) and the potential insurers.

Because of this, most of the contracts get stuck in the underwriting process and create huge administration expenses because of unnecessary interactions.

Another big problem for the insurance companies is that they don’t have the infrastructure to use the data they keep from their customers to decrease the fraud and the coverage expenses.

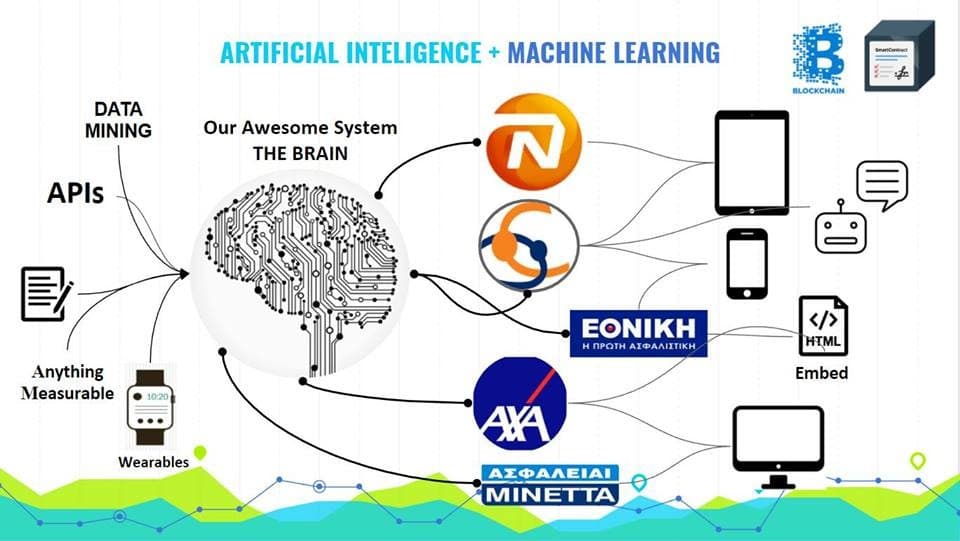

How these problems can be solved with technology

To solve these problems, we built 5 applications.

These tools can help

- Sales distribution channels (Brokers, Banks, Agents, etc.)

- Underwriting department

- Data assurance department

- Product development teams

- Marketing department etc.

Today we focus on our first product…

Brain Forms: All the paperwork but digital

With Brain Forms we are helping insurance companies to make the digital transition, providing them with a solution that can provide many benefits.

Some of the Brain Forms benefits

- Simplifying procedures

- Saving money

- Saving back-office resources

- Saving time

- Increase customer experience

With Brain Forms we provide modern technology that can run everywhere! In this way, with only one application, insurers will be able to see health insurance even through their mobile or chatbot.

To make it better… insurance companies’ partners will have the ability to sell health insurance products via their own website. Awesome?

And if you want more… we have already foreseen the possibility of a pre-issuance health check! If it is necessary, the insurance consultant will have the ability to schedule an appointment with the client on the spot.

As you can imagine, the consultant’s sales can scale quickly.

Also, if you are a Broker, guess what? The platform is so smart that it can give you access to every product of every company you have on your platform. And you can provide your customers with multiple products at the same time!

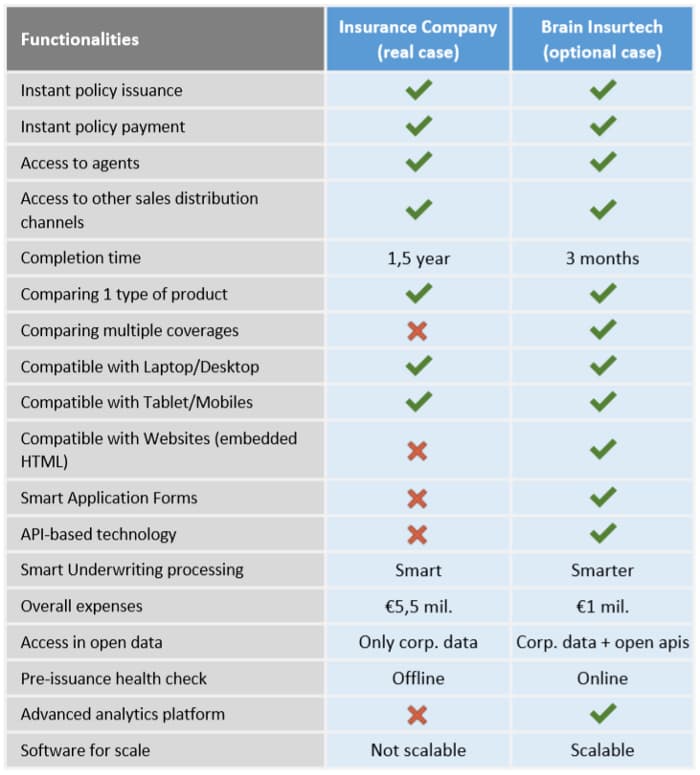

Why DIY (do it yourself) is a bad idea for Insurance business.

Nowadays, as any tech person knows, any software system needs daily improvement to be up to date.

Think of it: What would happen if any hotel in the world had to build a platform like booking.com or any taxi-driver had to build a platform like Taxi Beat!

Insurance companies have the resources to build a platform, but they don’t have the expertise to keep a platform up-to-date and they can’t invest many millions of euros every year in maintenance, research, updating, and development.

It is smarter to collaborate with somebody who knows the tech field.

In this way, insurance companies and partners achieve to have the complete product and all the new features at a much lower cost in money and manpower by achieving optimum value.

In summary, the insurance world must face huge paperwork and workflow problems to increase efficiency. However, it is necessary to accelerate and adopt innovative technologies.

For optimum savings of time, money, and human resources, we recommend using Brain software; the application is integrated EVERYWHERE!

In this way, the insurance business will have robust technologies with no need to build it.

Is our proposal a one-way trip to the world of technological evolution in the Industry 4.0 stage?